- Media Highlights

- 05/03/2018

Reborn-How the Company Is Listed on the A-Shares Market after Its Delisting from Taiwan (Business Today)

Written by Zhang Chaojun

USI creates market value of hundreds of millions of RMB in China with its miniaturization concepts.

What changes can happen to a company in eight years? It's no exaggeration to describe USI as having been "Reborn".

For Taiwanese investors, USI may sound unfamiliar. However, its predecessor, Universal Scientific Industrial, Co., Ltd. (USI-TW) is almost a household name, and its parent company, ASE Group that holds nearly 77% of the equity interest in USI, is even more famous. Delisted from Taiwan in 2010, the company changed its name to USI two years later and went listed on the A-shares market in Shanghai.

In just six years, USI has grown rapidly. In 2017, the revenue was NT$139.2 billion, representing an increase by 1.22 times from NT$62.5 billion in 2012. The net profit margin was 4.4%, ranking fifth in the global OEM industry. Its net profit throughout the year was NT$ 6,157 million, and its parent company ASE Group recognized a net profit of NT$4700 million.

With a high P/E ratio, USI is grabbing a bigger market share, and its market value has surpassed Compal and Inventec.

USI-TW which used to focus on manufacturing motherboards had a market value of only NT$22.8 billion when it was delisted from Taiwan. However, when it was listed in mainland China, its market value rose to NT$37.6 billion, and then rocketed to NT$120 billion, surpassing Compal and Inventec. According to Business Today's 2018 survey into the top 1,000 companies in mainland China, Hong Kong, Macau, and Taiwan in terms of market value, USI was ranked 609th.

While USI successfully completed its transformation from a "sparrow into a phoenix", "it's undoubtedly a bold move without precedent in Taiwan." When CY Wei, General Manager of USI, looked back on that period, his memories were still fresh.

Although its parent company ASE Group has a good political and economic relationship with mainland China, USI's listing on the market in mainland China was still full of challenges. Whether it could reverse the situation was totally up to the decision of the China Securities Regulatory Commission (CSRC).

CY Wei described the situation at the time as "waiting for an audience with the authorities." He said, "Several times, we flew to Beijing and Shanghai as scheduled, only to be stood up. Our meetings seemed to change at the whim of the authorities."

He pointed out that despite deficiencies in the laws and regulations in Taiwan and mainland China; it took USI's team two years to make every possible effort to overcome obstacles. Finally, in 2012, its listing was unanimously approved by members of the China Securities Regulatory Commission.

Wenqing Huang, deputy general manager of the research department of TSIA, said, "To have USI listed in China is probably because its parent company ASE Group wanted to exploit the high P/E ratio of stocks on the A-shares market in Shanghai to achieve the rapid growth of the market value of the Group."

He further added, "Compared with other Taiwan companies active in China, USI, as a company listed on the Chinese market, is in a better position to attract excellent local talents." Well-financed with a talent pool, USI was able to revolutionize its product line and achieve its corporate vision of miniaturized DMS.

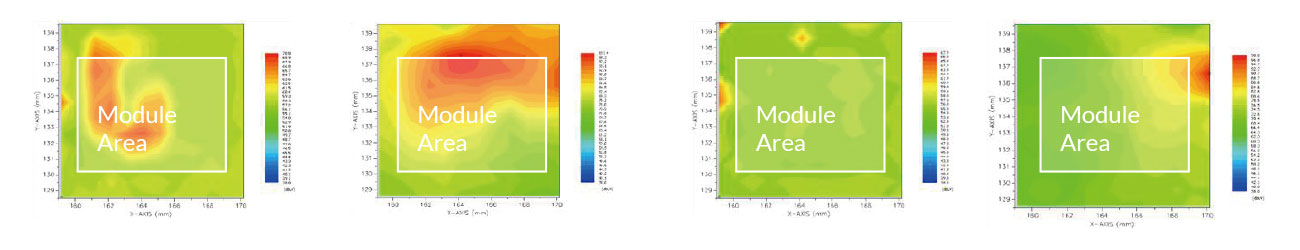

Spencer Chen, Chief of Staff of USI, said, "Miniaturization means packaging more parts into a smaller size." Take USI's leading product, the WiFi module for mobile phones, for example. It is embedded with more than 60 components, yet it is even smaller than a 1-NTD copper coin. Its technology is even more appealing when it's used on smart wearable devices. Inside a smart watch's chip, which is even smaller than a 50-NTD copper coin, more than 600 parts can be packaged.

"In 2017, the revenue from miniaturized products accounted for a large part of the total. To differentiate ourselves from most DMS manufacturers, we focus on miniaturization solutions (MSs) in the field of DMS," CY Wei called it the D(MS)2 model.

Instead of manufacturing products with a gross profit margin of 3% to 4%, we shift our attention to develop miniaturized solutions.

"We don't want to just manufacture products with a gross profit margin of 3% to 4%," Spencer Chen explained, "When USI was listed in China in 2012, the revenue from miniaturized solutions only represented 27% of the total. However, in 2017, the figure rose to 65%, and the annual revenue growth rate during the 6-year period reached as high as 37%."

Through the financial statements, it can be seen that USI invested NT$2,134 million on R&D activities. In 2017, the figure increased to NT$4,779 million. Spencer Chen pointed out, "In addition to the expanded business size that contributes to our increased R&D expenditures, and the unique characteristics of the industry determine that the gross profit margin of our products will decrease over time. If we don't invest money on developing new products and manufacturing processes, we won't be able to maintain our gross profit margin."

With the popularity of wearable devices and the increasingly smaller sizes of consumer electronics, "while it's difficult to reduce the size of batteries, it's inevitable for the packaging industry to embed as many parts as possible into smaller spaces, whether it's gold plating, wire bonding or wafer embedding," Qixin Yang, an analyst with IEK, said, "Today's wearable devices are diversified with a small volume. It's necessary for DMS manufacturers to invest more money on R&D activities."

In addition to product upgrading, USI's management is also improving the mindset of our workforce. CY Wei emphasized, "USI's most important management philosophy lies in the self-evaluation mechanism that helps develop our people's independent thinking and proposition abilities. Besides, we also allocate resources to trace their growth."

He gave smart manufacturing as an example, "We classified the contents of Industry 4.0 into different categories ranging from 1-Star to 5-Star, and required all our factory managers to identify which category they belong to. In the meanwhile, in terms of product attributes and sizes, we identified objectives and deadlines for all factories." After receipt of self-evaluation reports from all factories, the USI Industry 4.0 team provided accurate coaching on what resources should be allocated in which areas. As a result, the blueprint came into shape, and everything became clear.

Serving as a role model, CY Wei collected financial information about competitors each quarter to make comparisons to identify USI's ranking in the industry. Although USI was ranked 16th among more than 100 OEMs in terms of revenue, and its ranking in terms of net profit margin also rose from the 8th place in 2016 to the fifth, he commented on such ranking results as "acceptable performance" of the company.

In the face of China's continuous technological upgrading, what should we do to improve the competitiveness of Taiwan's DMS industry? CY Wei, with his forty years of experience, suggested that Taiwanese companies should learn from Japanese counterparts. For new markets and fields, it's important to form strategic alliances, and even consolidate companies to pool R&D funds to further accelerate technological advances.

There should not just be competition; instead, it's important to collaborate to create new business opportunities as technologies in different fields overlap.

Besides, CY Wei believes that among Taiwanese companies, "there should not just be competition. Collaboration, to some extent, is also important." He illustrated his point with the examples of emerging industries, such as the Internet of Things, self-driving cars, and artificial intelligence. While these fields seem widely different, there are actually technological overlaps. "If there's no communication between peers, problems such as over-investment and excessive production capacity expansion will occur, and even turn business opportunities into crises."

For USI, 2017 is a year of rebalance, while 2018 is a year of expansion. CY Wei described the development of the company as an S curve. He said, "All the products are in the process of changing. We constantly replace old ones with new ones, particularly in the rapidly technologically changing electronics industry."

While the decision to list the company on the A-shares market in Shanghai seemed to be a risky move at that time, its development over the past 6 years by eliminating products with low gross profit margins, developing new products, enhancing manufacturing techniques and processes, improving technologies, and refining services to compete with counterparts in mainland China is the real reason behind its success against all odds.

USI creates market value of hundreds of millions of RMB in China with its miniaturization concepts.

What changes can happen to a company in eight years? It's no exaggeration to describe USI as having been "Reborn".

For Taiwanese investors, USI may sound unfamiliar. However, its predecessor, Universal Scientific Industrial, Co., Ltd. (USI-TW) is almost a household name, and its parent company, ASE Group that holds nearly 77% of the equity interest in USI, is even more famous. Delisted from Taiwan in 2010, the company changed its name to USI two years later and went listed on the A-shares market in Shanghai.

In just six years, USI has grown rapidly. In 2017, the revenue was NT$139.2 billion, representing an increase by 1.22 times from NT$62.5 billion in 2012. The net profit margin was 4.4%, ranking fifth in the global OEM industry. Its net profit throughout the year was NT$ 6,157 million, and its parent company ASE Group recognized a net profit of NT$4700 million.

With a high P/E ratio, USI is grabbing a bigger market share, and its market value has surpassed Compal and Inventec.

USI-TW which used to focus on manufacturing motherboards had a market value of only NT$22.8 billion when it was delisted from Taiwan. However, when it was listed in mainland China, its market value rose to NT$37.6 billion, and then rocketed to NT$120 billion, surpassing Compal and Inventec. According to Business Today's 2018 survey into the top 1,000 companies in mainland China, Hong Kong, Macau, and Taiwan in terms of market value, USI was ranked 609th.

While USI successfully completed its transformation from a "sparrow into a phoenix", "it's undoubtedly a bold move without precedent in Taiwan." When CY Wei, General Manager of USI, looked back on that period, his memories were still fresh.

Although its parent company ASE Group has a good political and economic relationship with mainland China, USI's listing on the market in mainland China was still full of challenges. Whether it could reverse the situation was totally up to the decision of the China Securities Regulatory Commission (CSRC).

CY Wei described the situation at the time as "waiting for an audience with the authorities." He said, "Several times, we flew to Beijing and Shanghai as scheduled, only to be stood up. Our meetings seemed to change at the whim of the authorities."

He pointed out that despite deficiencies in the laws and regulations in Taiwan and mainland China; it took USI's team two years to make every possible effort to overcome obstacles. Finally, in 2012, its listing was unanimously approved by members of the China Securities Regulatory Commission.

Wenqing Huang, deputy general manager of the research department of TSIA, said, "To have USI listed in China is probably because its parent company ASE Group wanted to exploit the high P/E ratio of stocks on the A-shares market in Shanghai to achieve the rapid growth of the market value of the Group."

He further added, "Compared with other Taiwan companies active in China, USI, as a company listed on the Chinese market, is in a better position to attract excellent local talents." Well-financed with a talent pool, USI was able to revolutionize its product line and achieve its corporate vision of miniaturized DMS.

Spencer Chen, Chief of Staff of USI, said, "Miniaturization means packaging more parts into a smaller size." Take USI's leading product, the WiFi module for mobile phones, for example. It is embedded with more than 60 components, yet it is even smaller than a 1-NTD copper coin. Its technology is even more appealing when it's used on smart wearable devices. Inside a smart watch's chip, which is even smaller than a 50-NTD copper coin, more than 600 parts can be packaged.

"In 2017, the revenue from miniaturized products accounted for a large part of the total. To differentiate ourselves from most DMS manufacturers, we focus on miniaturization solutions (MSs) in the field of DMS," CY Wei called it the D(MS)2 model.

Instead of manufacturing products with a gross profit margin of 3% to 4%, we shift our attention to develop miniaturized solutions.

"We don't want to just manufacture products with a gross profit margin of 3% to 4%," Spencer Chen explained, "When USI was listed in China in 2012, the revenue from miniaturized solutions only represented 27% of the total. However, in 2017, the figure rose to 65%, and the annual revenue growth rate during the 6-year period reached as high as 37%."

Through the financial statements, it can be seen that USI invested NT$2,134 million on R&D activities. In 2017, the figure increased to NT$4,779 million. Spencer Chen pointed out, "In addition to the expanded business size that contributes to our increased R&D expenditures, and the unique characteristics of the industry determine that the gross profit margin of our products will decrease over time. If we don't invest money on developing new products and manufacturing processes, we won't be able to maintain our gross profit margin."

With the popularity of wearable devices and the increasingly smaller sizes of consumer electronics, "while it's difficult to reduce the size of batteries, it's inevitable for the packaging industry to embed as many parts as possible into smaller spaces, whether it's gold plating, wire bonding or wafer embedding," Qixin Yang, an analyst with IEK, said, "Today's wearable devices are diversified with a small volume. It's necessary for DMS manufacturers to invest more money on R&D activities."

In addition to product upgrading, USI's management is also improving the mindset of our workforce. CY Wei emphasized, "USI's most important management philosophy lies in the self-evaluation mechanism that helps develop our people's independent thinking and proposition abilities. Besides, we also allocate resources to trace their growth."

He gave smart manufacturing as an example, "We classified the contents of Industry 4.0 into different categories ranging from 1-Star to 5-Star, and required all our factory managers to identify which category they belong to. In the meanwhile, in terms of product attributes and sizes, we identified objectives and deadlines for all factories." After receipt of self-evaluation reports from all factories, the USI Industry 4.0 team provided accurate coaching on what resources should be allocated in which areas. As a result, the blueprint came into shape, and everything became clear.

Serving as a role model, CY Wei collected financial information about competitors each quarter to make comparisons to identify USI's ranking in the industry. Although USI was ranked 16th among more than 100 OEMs in terms of revenue, and its ranking in terms of net profit margin also rose from the 8th place in 2016 to the fifth, he commented on such ranking results as "acceptable performance" of the company.

In the face of China's continuous technological upgrading, what should we do to improve the competitiveness of Taiwan's DMS industry? CY Wei, with his forty years of experience, suggested that Taiwanese companies should learn from Japanese counterparts. For new markets and fields, it's important to form strategic alliances, and even consolidate companies to pool R&D funds to further accelerate technological advances.

There should not just be competition; instead, it's important to collaborate to create new business opportunities as technologies in different fields overlap.

Besides, CY Wei believes that among Taiwanese companies, "there should not just be competition. Collaboration, to some extent, is also important." He illustrated his point with the examples of emerging industries, such as the Internet of Things, self-driving cars, and artificial intelligence. While these fields seem widely different, there are actually technological overlaps. "If there's no communication between peers, problems such as over-investment and excessive production capacity expansion will occur, and even turn business opportunities into crises."

For USI, 2017 is a year of rebalance, while 2018 is a year of expansion. CY Wei described the development of the company as an S curve. He said, "All the products are in the process of changing. We constantly replace old ones with new ones, particularly in the rapidly technologically changing electronics industry."

While the decision to list the company on the A-shares market in Shanghai seemed to be a risky move at that time, its development over the past 6 years by eliminating products with low gross profit margins, developing new products, enhancing manufacturing techniques and processes, improving technologies, and refining services to compete with counterparts in mainland China is the real reason behind its success against all odds.